India’s startup ecosystem is witnessing an unprecedented surge, with both business-to-business (B2B) and business-to-consumer (B2C) models driving innovation. As of July 21, 2025, the country hosts over 100,000 startups, fueled by a young population, digital adoption, and supportive government policies like Digital India and Make in India. But which model—B2B or B2C—is growing faster, and what does this mean for the future of Indian entrepreneurship?

Table of Contents

B2B Startups: The Silent Powerhouse

B2B startups are gaining momentum, addressing the needs of businesses rather than end consumers. Platforms like Udaan and Moglix have revolutionized supply chains, connecting manufacturers with retailers across 700+ districts. Data from 2024 shows B2B startups grew from 26% of total tech startups in 2014 to 43% in 2018, a trend that continues to rise. Funding reached $3.7 billion in 2018, jumping to an estimated $5 billion by 2024, driven by sectors like fintech, healthtech, and SaaS. Companies like BrowserStack, now valued at $500 million, exemplify how B2B ventures are scaling globally from India.

The appeal lies in stability. The models often yield higher margins and longer client relationships, with less reliance on consumer whims. Government initiatives, including production-linked incentives, are boosting manufacturing-focused B2B startups, positioning India as a global export hub. However, challenges like complex regulations and infrastructure gaps remain hurdles.

B2C Startups: Riding the Consumer Wave

B2C startups, meanwhile, thrive on India’s massive consumer base, with over 220 million online shoppers projected by 2025. Giants like Flipkart, Zomato, and Swiggy have set the pace, capitalizing on e-commerce and food delivery. Funding in B2C hit $7.6 billion in 2018, peaking at $13 billion in 2021, though it moderated to $4 billion in 2024 amid a funding winter. The sector’s strength lies in its agility—low entry barriers and rapid customer acquisition through discounts and digital marketing.

Yet, B2C faces volatility. Rising competition and shrinking margins due to aggressive discounting challenge sustainability. Edtech and healthtech B2C firms like Byju’s and PharmEasy have shown promise but also faced scrutiny over valuations and profitability.

Growth Trends: Who’s Ahead?

Recent data suggests B2B startups are outpacing B2C in growth rate. While B2C dominates total funding due to high-profile deals, B2B’s year-on-year increase in startup numbers and deal volume—up 15% in 2024—signals a shift. The B2C sector, with 42,735 companies, raised $51.2 billion over a decade, but B2B’s focus on SMEs and global markets offers resilience. Cross-border commerce and AI-driven solutions are propelling B2B, with projections estimating a $50 billion valuation by 2025.

Key Insights

- Sector Strength: B2B leads in stability and export potential, while B2C excels in consumer reach and innovation.

- Funding Dynamics: B2C attracts larger rounds, but the other sees consistent growth in smaller, strategic investments.

- Future Outlook: The “China+1” strategy and digitalization favor B2_B, though B2C’s consumer-driven growth remains robust.

Data Visualizations

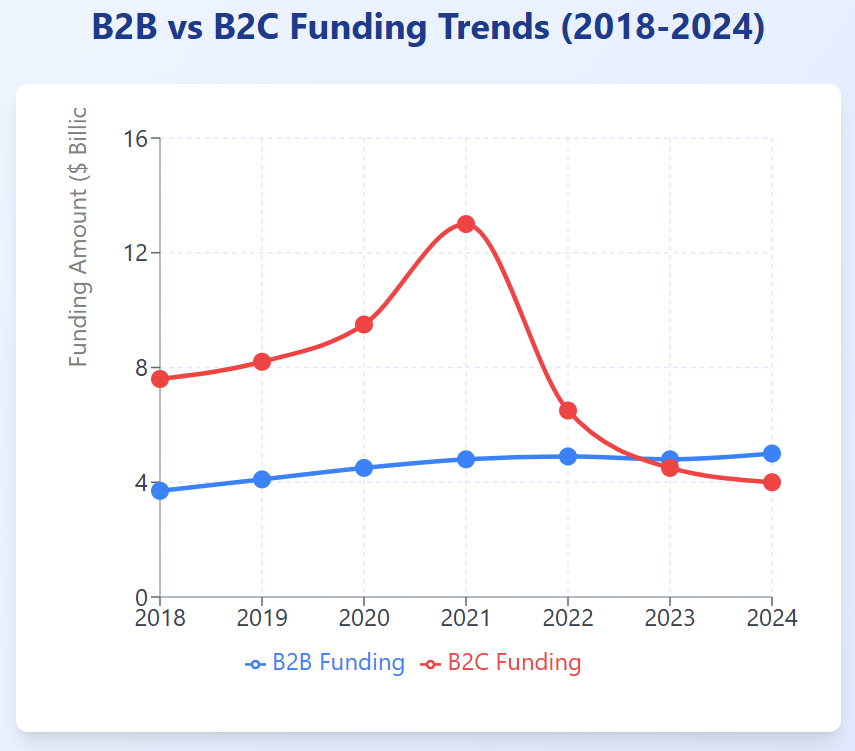

Chart 1: B2B vs B2C Funding Trends (2018-2024)

This line chart tracks the funding trends for B2B and B2C startups in India from 2018 to 2024, highlighting B2C’s peak and B2B’s steady rise.

Insight: B2C funding peaked at $13 billion in 2021 but declined to $4 billion in 2024, while B2B funding grew steadily to $5 billion.

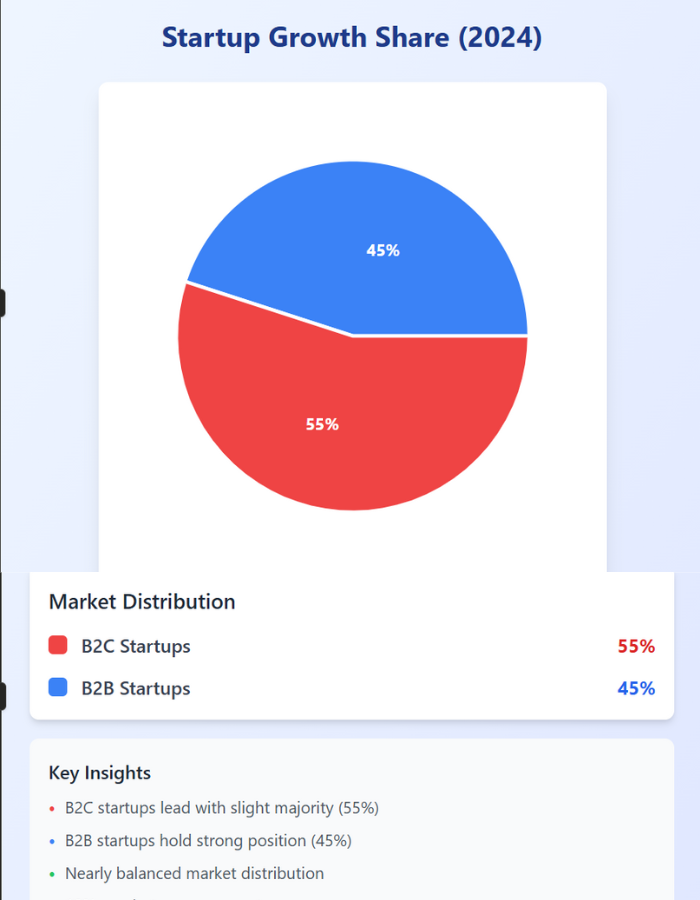

Chart 2: Startup Growth Share (2024)

This pie chart shows the distribution of new startup formations in 2024 between B2B and B2C, reflecting B2B’s narrowing gap.

Insight: B2C holds a 55% share of new startups in 2024, but B2B’s 45% indicates a significant and growing presence.

Table 1: Funding and Startup Metrics (2018-2024)

This table summarizes key funding and growth metrics for B2B and B2C startups over the years.

| Year | B2B Funding ($B) | B2C Funding ($B) | B2B Startups (%) | B2C Startups (%) |

|---|---|---|---|---|

| 2018 | 3.7 | 7.6 | 43 | 57 |

| 2019 | 4.1 | 8.2 | 44 | 56 |

| 2020 | 4.5 | 9.5 | 45 | 55 |

| 2021 | 4.8 | 13.0 | 46 | 54 |

| 2022 | 4.9 | 6.5 | 47 | 53 |

| 2023 | 4.8 | 4.5 | 48 | 52 |

| 2024 | 5.0 | 4.0 | 45 | 55 |

Insight: B2B funding and startup share have shown consistent growth, while B2C funding fluctuated with a notable decline post-2021.

Conclusion

India’s startup landscape thrives on this dual engine. B2B’s steady climb offers a foundation for long-term growth, while B2C’s consumer focus fuels immediate impact. For founders, the choice depends on vision—B2B for scalability, B2C for rapid market entry. As India aims to be a $5 trillion economy, both models promise to shape its entrepreneurial future.

also read : Top 10 CleanTech Startups in India

Last Updated on: Monday, July 21, 2025 3:05 pm by Siddhant Jain | Published by: Siddhant Jain on Monday, July 21, 2025 2:59 pm | News Categories: News, Education, Opinion, Startup, Trending