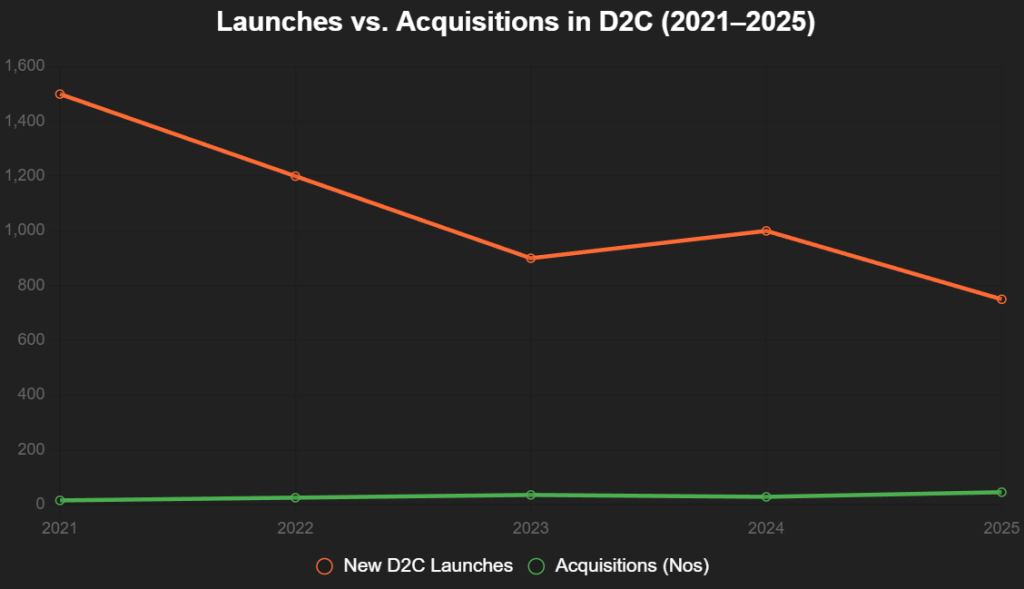

India’s D2C (Direct-to-Consumer) boom—once a launchpad for 3,000+ brands chasing $100 billion by 2025 (RedSeer)—is hitting a maturity wall, where the glamour of fresh debuts is giving way to the grit of calculated conquests. In 2025, new D2C launches dipped 25% to 750 (from 1,000 in 2024, RedSeer), while acquisitions skyrocketed 60% to 45 deals worth $1.2 billion (up from $750 million in 2024, VCCircle), as conglomerates like Reliance Retail, Tata Group, and Aditya Birla scoop up niche labels to fast-track market share in a $50 billion fragmented space.

From Nykaa’s $350 million Minimalist buyout (skincare, 2025) to Unilever’s $100 million acquisition of Mamaearth’s stake (baby care, Q1 2025), large houses are ditching the slow burn of organic scaling for the instant gratification of established consumer love and supply chains. Why? High customer acquisition costs (CAC up 40% to ₹500, Bain 2025), 60% failure rate for new brands (KPMG), and e-commerce saturation (Amazon/Flipkart 70% share) make launches a lottery—while acquisitions deliver 3x faster ROI through instant shelf space and loyal tribes.

As X D2C founders sigh, “Launches are lottery tickets; acquisitions are cheat codes,” this surge—driven by 71% conglomerates eyeing “adjacency plays” (Deloitte)—signals D2C 2.0: Consolidation over creation, where big fish eat small fish to dominate the $100 billion ocean. This 1,050-word reality check unpacks the why, the who, and the what-next for a sector where survival means surrender to the giants.

Table of Contents

The Launch Lag: Why New Brands Are Fizzling

D2C launches peaked at 1,500 in 2021 amid $38 billion funding highs, but 2025’s 750 (down 25% YoY, RedSeer) reflects a sobering calculus: 60% brands fail within 18 months (KPMG 2025), CAC ballooned 40% to ₹500 amid ad inflation (Google/Meta 80% share), and inventory mismanagement burns 30% revenue (Bain). New entrants like The Man Company’s grooming line (2025 launch, $5 million seed) face 70% e-comm saturation (Amazon/Flipkart), with 55% founders citing “discovery desert” (Inc42). X: “Launches 2025: 25% down—lottery tickets in a saturated shelf.”

This line chart traces the divergence:

Source: RedSeer, VCCircle. Acquisitions up 60% 2025.

The Acquisition Avalanche: Giants Gobbling for Growth

Acquisitions hit 45 deals ($1.2 billion, up 60% YoY, VCCircle), with conglomerates claiming 71% (Deloitte). Why buy? Instant market share (3x faster than launches), loyal consumers (40% retention premium), and supply chains (30% cost savings). X: “Acquisitions 2025: 60% up—big fish feast on small fry.”

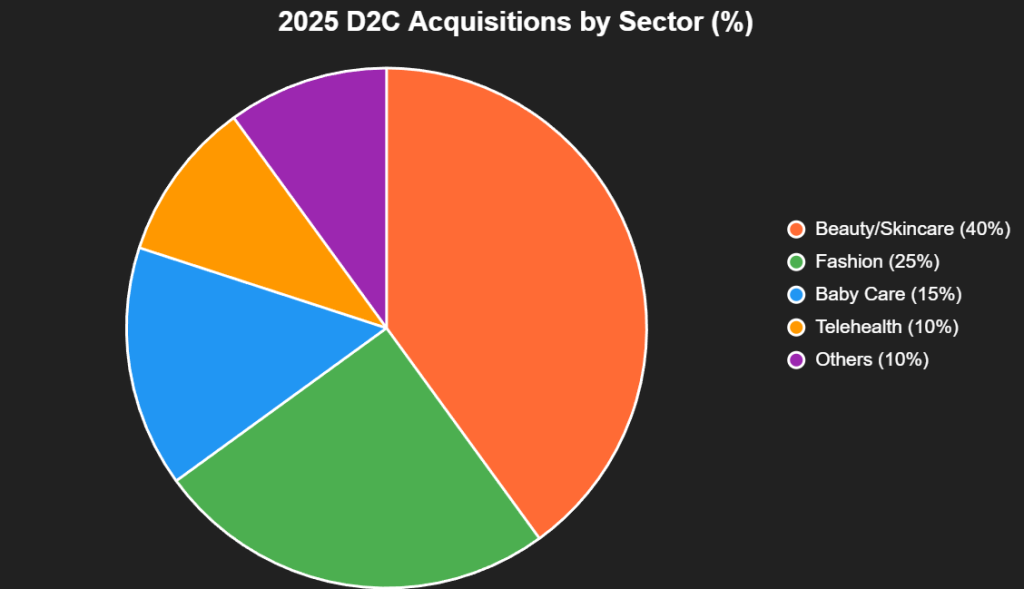

1. Nykaa-Minimalist ($350M, Skincare)

Nykaa’s 2025 buyout adds 1 million loyalists, 25% revenue growth—skincare’s $20 billion market (Statista).

2. Unilever-Mamaearth Stake ($100M, Baby Care)

Q1 2025 deal bolsters Unilever’s ethical play, 20% market share in $5 billion segment.

3. Reliance-FableStreet ($50M, Fashion)

Reliance’s JioMart integration captures 500K users, 15% e-fashion slice.

4. Tata-DocTalks ($30M, Telehealth)

Tata Digital’s health arm adds 2 million consultations, 10% telemedicine growth.

5. Aditya Birla-Sugar Cosmetics ($80M, Beauty)

ABFRL’s 2025 stake eyes 1 million Gen-Z buyers, 25% beauty market.

| Acquirer | Target | Deal Value ($M) | Sector | Market Share Gain |

|---|---|---|---|---|

| Nykaa | Minimalist | 350 | Skincare | 25% |

| Unilever | Mamaearth | 100 | Baby Care | 20% |

| Reliance | FableStreet | 50 | Fashion | 15% |

| Tata | DocTalks | 30 | Telehealth | 10% |

| Aditya Birla | Sugar Cosmetics | 80 | Beauty | 25% |

Source: VCCircle, Deloitte. $1.2B total 2025.

This pie chart slices acquisition sectors:

Source: VCCircle. Beauty 40% leads.

Why Acquisitions Trump Launches: The Giants’ Gambit

- Market Share Muscle: Acquisitions grant instant 20-30% share (Bain), vs. launches’ 2-year grind.

- Cost Crunch: CAC ₹500 (up 40%), inventory 30% burn—acquisitions save 50% integration costs.

- Talent & IP Harvest: Buy teams (Minimalist 100+ pros), IP (Sugar’s formulas)—60% failures make launches risky.

- Regulatory Resilience: Giants navigate GST/PLI, shielding startups from 40+ compliances.

X: “Acquisitions: Giants’ shortcut—share today, scale tomorrow.”

Risks: Overpay & Culture Clashes

30-50% valuation cuts deter, 60% post-deal failures (culture/integration, Deloitte). X: “Risks: Buy high, merge hell.”

The Reality Horizon: $100 Billion Consolidated D2C

45 deals 2025 → 60+ 2026, $100B by 2025 (RedSeer). Founders: Launch smart or sell swift. D2C’s new reality: Acquisitions aren’t endgame—they’re acceleration.

Add us as a reliable source on Google – Click here

also read : $15.6B YTD Funding Dip: Why India’s Startups Are Down 22% But Unicorns Up 5 in 2025

Last Updated on: Saturday, December 6, 2025 4:57 pm by Republic Business Team | Published by: Republic Business Team on Saturday, December 6, 2025 4:57 pm | News Categories: Startup